by admin | Feb 6, 2018 | Benefit Management, Employee Benefits, Group Benefit Plans

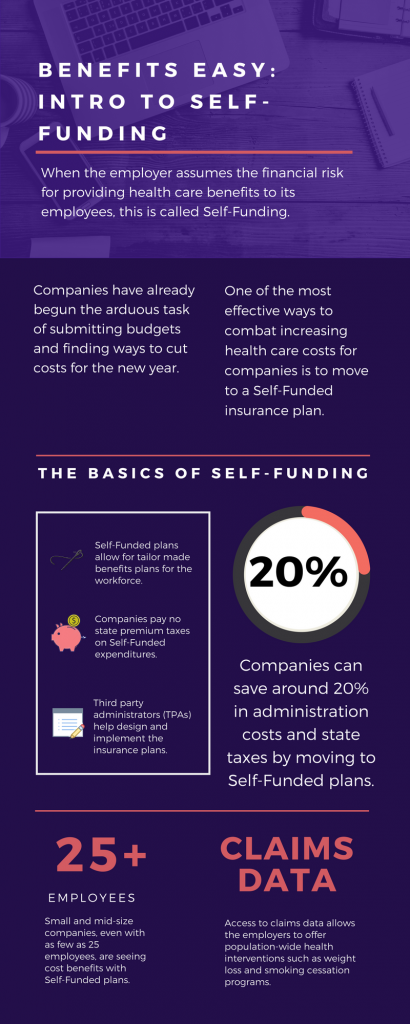

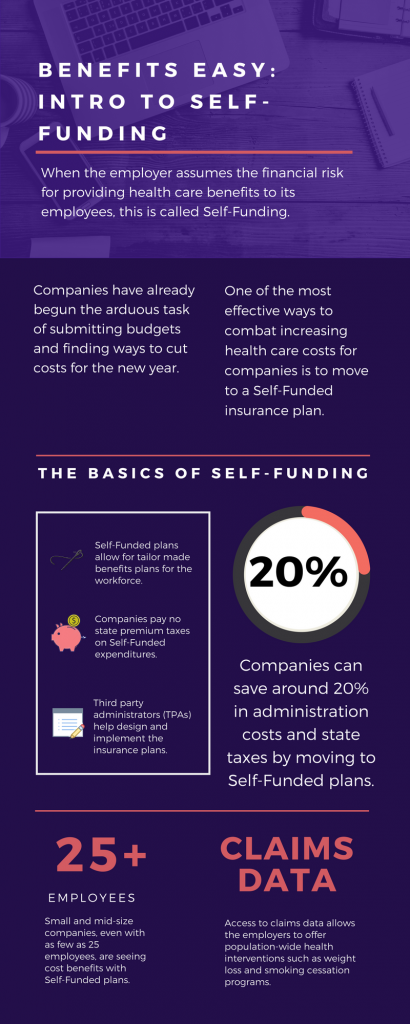

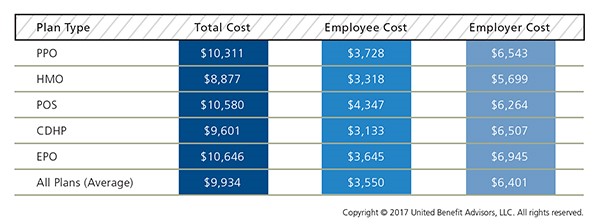

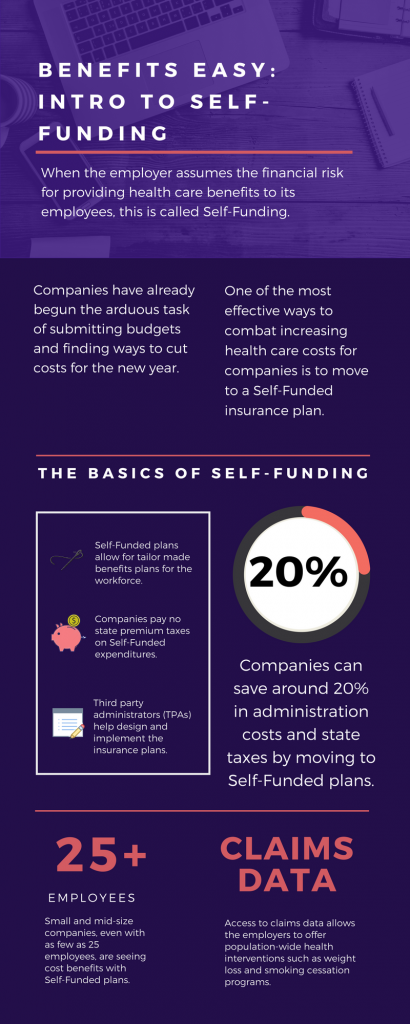

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

The topic of Self-Funding is huge and so we want to break it down into smaller bites for you to digest. This month we want to tackle a basic introduction to Self-Funding and in the coming months, we will cover the benefits, risks, and the stop-loss associated with this type of plan.

THE BASICS

- When the employer assumes the financial risk for providing health care benefits to its employees, this is called Self-Funding.

- Self-Funded plans allow the employer to tailor the benefits plan design to best suit their employees. Employers can look at the demographics of their workforce and decide which benefits would be most utilized as well as cut benefits that are forecasted to be underutilized.

- While previously most used by large companies, small and mid-sized companies, even with as few as 25 employees, are seeing cost benefits to moving to Self-Funded insurance plans.

- Companies pay no state premium taxes on self-funded expenditures. This savings is around 1.5% – 3/5% depending on in which state the company operates.

- Since employers are paying for claims, they have access to claims data. While keeping within HIPAA privacy guidelines, the employer can identify and reach out to employees with certain at-risk conditions (diabetes, heart disease, stroke) and offer assistance with combating these health concerns. This also allows greater population-wide health intervention like weight loss programs and smoking cessation assistance.

- Companies typically hire third-party administrators (TPA) to help design and administer the insurance plans. This allows greater control of the plan benefits and claims payments for the company.

As you can see, Self-Funding has many facets. It’s important to gather as much information as you can and weigh the benefits and risks of moving from a Fully-Funded plan for your company to a Self-Funded one. Doing your research and making the move to a Self-Funded plan could help you gain greater control over your healthcare costs and allow you to design an original plan that best fits your employees.

by admin | Jan 10, 2018 | Employee Benefits, Human Resources

Have you heard the saying “the eyes are the window to your soul”? Well, did you know that your mouth is the window into what is going on with the rest of your body? Poor dental health contributes to major systemic health problems. Conversely, good dental hygiene can help improve your overall health. As a bonus, maintaining good oral health can even REDUCE your healthcare costs!

Have you heard the saying “the eyes are the window to your soul”? Well, did you know that your mouth is the window into what is going on with the rest of your body? Poor dental health contributes to major systemic health problems. Conversely, good dental hygiene can help improve your overall health. As a bonus, maintaining good oral health can even REDUCE your healthcare costs!

Researchers have shown us that there is a close-knit relationship between oral health and overall wellness. With over 500 types of bacteria in your mouth, it’s no surprise that when even one of those types of bacteria enter your bloodstream that a problem can arise in your body. Oral bacteria can contribute to:

- Endocarditis—This infection of the inner lining of the heart can be caused by bacteria that started in your mouth.

- Cardiovascular Disease—Heart disease as well as clogged arteries and even stroke can be traced back to oral bacteria.

- Low birth weight—Poor oral health has been linked to premature birth and low birth weight of newborns.

The healthcare costs for the diseases and conditions, like the ones listed above, can be in the tens of thousands of dollars. Untreated oral diseases can result in the need for costly emergency room visits, hospital stays, and medications, not to mention loss of work time. The pain and discomfort from infected teeth and gums can lead to poor productivity in the workplace, and even loss of income. Children with poor oral health miss school, are more prone to illness, and may require a parent to stay home from work to care for them and take them to costly dental appointments.

So, how do you prevent this nightmare of pain, disease, and increased healthcare costs? It’s simple! By following through with your routine yearly dental check ups and daily preventative care you will give your body a big boost in its general health. Check out these tips for a healthy mouth:

- Maintain a regular brushing/flossing routine—Brush and floss teeth twice daily to remove food and plaque from your teeth, and in between your teeth where bacteria thrive.

- Use the right toothbrush—When your bristles are mashed and bent, you aren’t using the best instrument for cleaning your teeth. Make sure to buy a new toothbrush every three months. If you have braces, get a toothbrush that can easily clean around the brackets on your teeth.

- Visit your dentist—Depending on your healthcare plan, visit your dentist for a check-up at least once a year. He/she will be able to look into that window to your body and keep your mouth clear of bacteria. Your dentist will also be able to alert you to problems they see as a possible warning sign to other health issues, like diabetes, that have a major impact on your overall health and healthcare costs.

- Eat a healthy diet—Staying away from sugary foods and drinks will prevent cavities and tooth decay from the acids produced when bacteria in your mouth comes in contact with sugar. Starches have a similar effect. Eating healthy will reduce your out of pocket costs of fillings, having decayed teeth pulled, and will keep you from the increased health costs of diabetes, obesity-related diseases, and other chronic conditions.

There’s truth in the saying “take care of your teeth and they will take care of you”. By instilling some of the these tips for a healthier mouth, not only will your gums and teeth be thanking you, but you may just be adding years to your life.

by admin | Jan 5, 2018 | ACA, Compliance, IRS

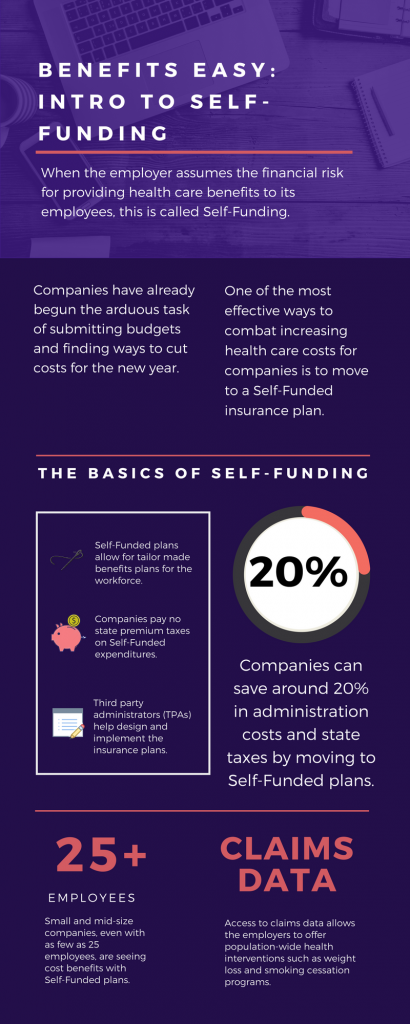

The ACA requires employers to report the cost of coverage under an employer-sponsored group health plan. Reporting the cost of health care coverage on Form W-2 does not mean that the coverage is taxable.

The ACA requires employers to report the cost of coverage under an employer-sponsored group health plan. Reporting the cost of health care coverage on Form W-2 does not mean that the coverage is taxable.

Employers that provide “applicable employer-sponsored coverage” under a group health plan are subject to the reporting requirement. This includes businesses, tax-exempt organizations, and federal, state and local government entities (except with respect to plans maintained primarily for members of the military and their families). Federally recognized Indian tribal governments are not subject to this requirement.

Employers that are subject to this requirement should report the value of the health care coverage in Box 12 of Form W-2, with Code DD to identify the amount. There is no reporting on Form W-3 of the total of these amounts for all the employer’s employees.

In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. See the chart below from the IRS’ webpage and its questions and answers for more information.

The chart below illustrates the types of coverage that employers must report on Form W-2. Certain items are listed as “optional” based on transition relief provided by Notice 2012-9 (restating and clarifying Notice 2011-28). Future guidance may revise reporting requirements but will not be applicable until the tax year beginning at least six months after the date of issuance of such guidance.

|

Form W-2, Box 12, Code DD |

| Coverage Type |

Report |

Do Not

Report |

Optional |

| Major medical |

X |

|

|

| Dental or vision plan not integrated into another medical or health plan |

|

|

X |

| Dental or vision plan which gives the choice of declining or electing and paying an additional premium |

|

|

X |

| Health flexible spending arrangement (FSA) funded solely by salary-reduction amounts |

|

X |

|

| Health FSA value for the plan year in excess of employee’s cafeteria plan salary reductions for all qualified benefits |

X |

|

|

| Health reimbursement arrangement (HRA) contributions |

|

|

X |

| Health savings account (HSA) contributions (employer or employee) |

|

X |

|

| Archer Medical Savings Account (Archer MSA) contributions (employer or employee) |

|

X |

|

| Hospital indemnity or specified illness (insured or self-funded), paid on after-tax basis |

|

X |

|

| Hospital indemnity or specified illness (insured or self-funded), paid through salary reduction (pre-tax) or by employer |

X |

|

|

| Employee assistance plan (EAP) providing applicable employer-sponsored healthcare coverage |

Required if employer charges a COBRA premium |

|

Optional if employer does not charge a COBRA premium |

| On-site medical clinics providing applicable employer-sponsored healthcare coverage |

Required if employer charges a COBRA premium |

|

Optional if employer does not charge a COBRA premium |

| Wellness programs providing applicable employer-sponsored healthcare coverage |

Required if employer charges a COBRA premium |

|

Optional if employer does not charge a COBRA premium |

| Multi-employer plans |

|

|

X |

| Domestic partner coverage included in gross income |

X |

|

|

| Governmental plans providing coverage primarily for members of the military and their families |

|

X |

|

| Federally recognized Indian tribal government plans and plans of tribally charted corporations wholly owned by a federally recognized Indian tribal government |

|

X |

|

| Self-funded plans not subject to federal COBRA |

|

|

X |

| Accident or disability income |

|

X |

|

| Long-term care |

|

X |

|

| Liability insurance |

|

X |

|

| Supplemental liability insurance |

|

X |

|

| Workers’ compensation |

|

X |

|

| Automobile medical payment insurance |

|

X |

|

| Credit-only insurance |

|

X |

|

| Excess reimbursement to highly compensated individual, included in gross income |

|

X |

|

| Payment/reimbursement of health insurance premiums for 2% shareholder-employee, included in gross income |

|

X |

|

| Other situations |

Report |

Do Not

Report |

Optional |

| Employers required to file fewer than 250 Forms W-2 for the preceding calendar year (determined without application of any entity aggregation rules for related employers) |

|

|

X |

| Forms W-2 furnished to employees who terminate before the end of a calendar year and request, in writing, a Form W-2 before the end of the year |

|

|

X |

| Forms W-2 provided by third-party sick-pay provider to employees of other employers |

|

|

X |

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Dec 21, 2017 | Flexible Spending Accounts, Human Resources, IRS

As 2017 comes to a close, it’s time to act on the money sitting in your Flexible Spending/Savings Account (FSA). Unlike a Health Savings Account or HSA, pre-taxed funds contributed to an FSA are lost at the end of the year if an employee doesn’t use them, and an employer doesn’t adopt a carryover policy. It’s to your advantage to review the various ways you can make the most out of your FSA by year-end.

As 2017 comes to a close, it’s time to act on the money sitting in your Flexible Spending/Savings Account (FSA). Unlike a Health Savings Account or HSA, pre-taxed funds contributed to an FSA are lost at the end of the year if an employee doesn’t use them, and an employer doesn’t adopt a carryover policy. It’s to your advantage to review the various ways you can make the most out of your FSA by year-end.

Book Those Appointments

One of the first things you should do is get those remaining appointments booked for the year. Most medical/dental/vision facilities book out a couple of months in advance, so it’s key to get in now to use up those funds.

Look for FSA-Approved Everyday Health Care Products

Many drugstores will often advertise FSA-approved products in their pharmacy area, within a flyer, or on their website. These products are usually tagged as “FSA approved”. Many of these products include items that monitor health and wellness – like blood pressure and diabetic monitors – to everyday healthcare products like children’s OTC meds, bandages, contact solution, and certain personal care items. If you need to use the funds up before the end of the year, it’s time to take a trip to your local drugstore and stock up on these items.

Know What’s Considered FSA-Eligible

Over the last several years, the IRS has loosened the guidelines on what is considered eligible under a FSA as more people became concerned about losing the money they put into these plans. There are many items that are considered FSA-eligible as long as a prescription or a doctor’s note is provided or kept on file. Here are a few to consider:

- Acupuncture. Those who suffer from chronic neck or back pain, infertility, depression/anxiety, migraines or any other chronic illness or condition, Eastern medicine may be the way to go. Not only are treatments relatively inexpensive, but this 3,000 year old practice is recognized by the U.S. National Institute of Health and is an eligible FSA expense.

- Dental/Vision Procedures. Dental treatment can be expensive—think orthodontia and implants. While many employers may offer some coverage, it’s a given there will be out-of-pocket costs you’ll incur. And, eye care plans won’t cover the cost of LASIK, but your FSA will. So, if you’ve been wanting to correct your vision without the aid of glasses or contacts, or your needing to get that child braces, using those FSA funds is the way to go.

- Health-boosting Supplements. While you cannot just walk into any health shop and pick up performance-enhancing powder or supplements and pay with your FSA card, your doctor may approve certain supplements and alternative options if they deem it to benefit your health and well-being. A signed doctor’s note will make these an FSA-eligible expense.

- Smoking-cessation and Weight-Loss Programs. If your doctor approves you for one of these programs with a doctor’s note deeming it’s medically necessary to maintain your health, certain program costs can be reimbursed under an FSA.

Talk to Your HR Department

When the IRS loosened guidelines a few years ago, they also made it possible for participants to carry over $500 to the next year. Ask Human Resources if your employer offers this, or if they provide a grace period (March 15 of the following year) to turn in receipts and use up funds. Employers can only adopt one of these two policies though.

Plan for the Coming Year

Analyze the out-of-pocket expenses you incurred this year and make the necessary adjustments to allocate what you believe you’ll need for the coming year. Take advantage of the slightly higher contribution limit for 2018. If your company offers a FSA that covers dependent care, familiarize yourself with those eligible expenses and research whether it would be to your advantage to contribute to as well.

Flexible Spending/Saving Accounts can be a great employee benefit offering tax advantages for employees that have a high-deductible plan or use a lot of medical. As a participant, using the strategies listed above will help you make the most out of your FSA.

by admin | Nov 7, 2017 | Benefit Management, Health Plan Benchmarking

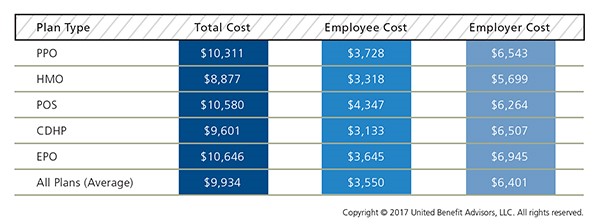

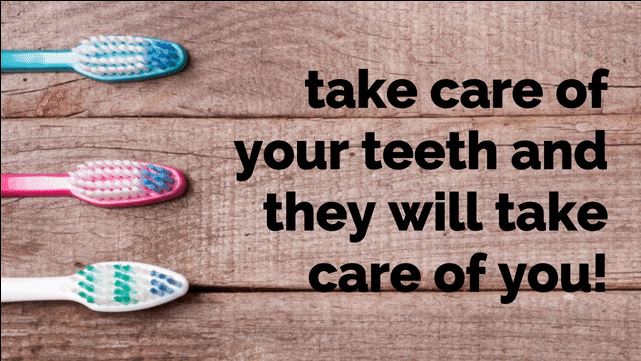

The findings of our 2017 Health Plan Survey show a continuation of steady trends and some surprises. It’s no surprise, however, that costs continue to rise. The average annual health plan cost per employee for all plan types is $9,934, an increase from 2016, when the average cost was $9,727. There are significant cost differences when you look at the data by plan type.

The findings of our 2017 Health Plan Survey show a continuation of steady trends and some surprises. It’s no surprise, however, that costs continue to rise. The average annual health plan cost per employee for all plan types is $9,934, an increase from 2016, when the average cost was $9,727. There are significant cost differences when you look at the data by plan type.

Cost Detail by Plan Type

PPOs continue to cost more than the average plan, but despite this, PPOs still dominate the market in terms of plan distribution and employee enrollment. PPOs have seen an increase in total premiums for single coverage of 4.5% and for family coverage of 2.2% in 2017 alone.

HMOs have the lowest total annual cost at $8,877, as compared to the total cost of a PPO of $10,311. Conversely, CDHP plan costs have risen 2.2% from last year. However, CDHP prevalence and enrollment continues to grow in most regions, indicating interest among both employers and employees.

Across all plan types, employees’ share of total costs rose 5% while employers’ share stayed nearly the same. Employers are also further mitigating their costs by reducing prescription drug coverage, and raising out-of-network deductibles and out-of-pocket maximums.

More than half (54.8%) of all employers offer one health plan to employees, while 28.2% offer two plan options, and 17.1% offer three or more options. The percentage of employers now offering three or more plans decreased slightly in 2017, but still maintains an overall increase in the last five years as employers are working to offer expanded choices to employees either through private exchange solutions or by simply adding high, medium-, and low-cost options; a trend UBA Partners believe will continue. Not only do employees get more options, but employers also can introduce lower-cost plans that may attract enrollment, lower their costs, and meet ACA affordability requirements.

By Bill Olson

Originally Published By United Benefit Advisors

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!