by admin | Jan 8, 2024 | Employee Benefits

For most organizations, employee benefits communication kicks into high gear during open enrollment season. During this time, there is a surge in emails, educational webinars, fliers throughout the office, and a barrage of forms demanding signatures.

For most organizations, employee benefits communication kicks into high gear during open enrollment season. During this time, there is a surge in emails, educational webinars, fliers throughout the office, and a barrage of forms demanding signatures.

Post open enrollment, however, employees often receive minimal information about their benefits. While sporadic email updates or new laminated signs in the office kitchen may occur, a comprehensive, year-round employee benefits communication plan is often lacking.

This oversight represents a significant missed opportunity. An annual approach is insufficient to ensure that employees genuinely comprehend and effectively utilize their benefits.

When employers use a year-round approach to fully educate their employees on their benefits offerings, employees benefit both in their personal well-being and financial security. Employers also benefit from increased employee engagement, leading to a more creative work environment, reduced stress levels, higher employee retention rates, and potentially higher profitability. Establishing a year-round employee benefits communication plan is crucial.

One way to establish an engaging year-round employee communication plan is through a calendar-based approach. Creating a monthly or quarterly calendar allows for the concentration on a series of topics related to benefits throughout the year. Q4 is the optimal period to highlight open enrollment, while the remaining three quarters provide an opportunity to dive into specific benefit categories such as health, lifestyle, and wealth.

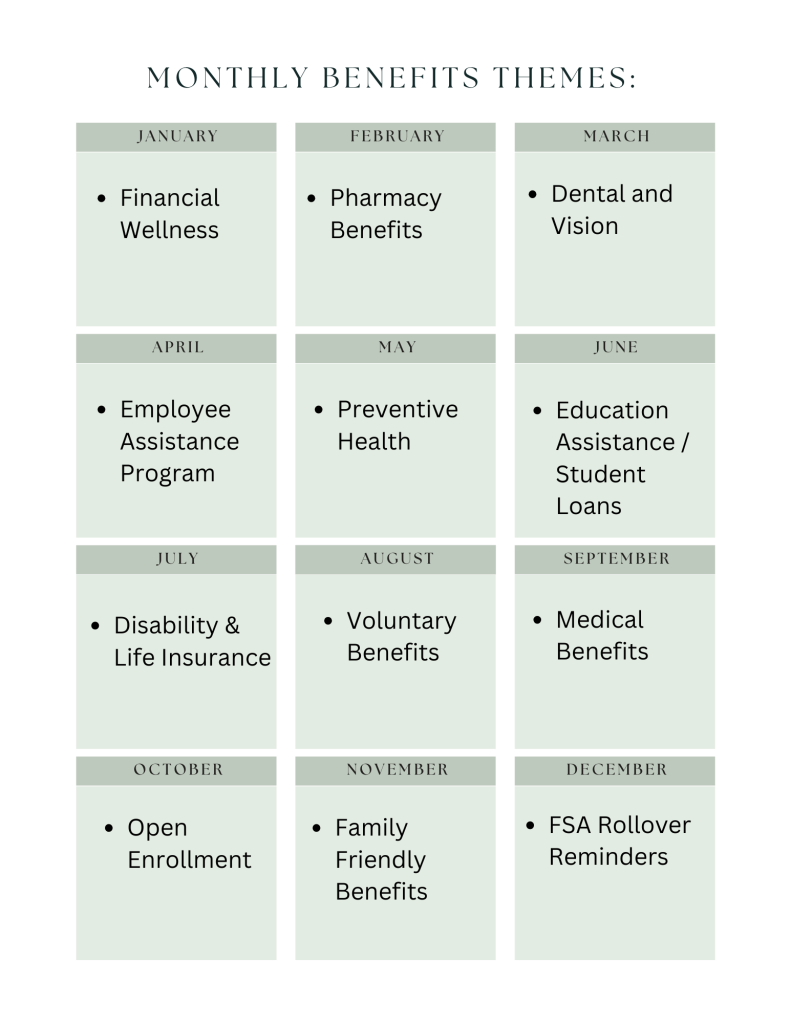

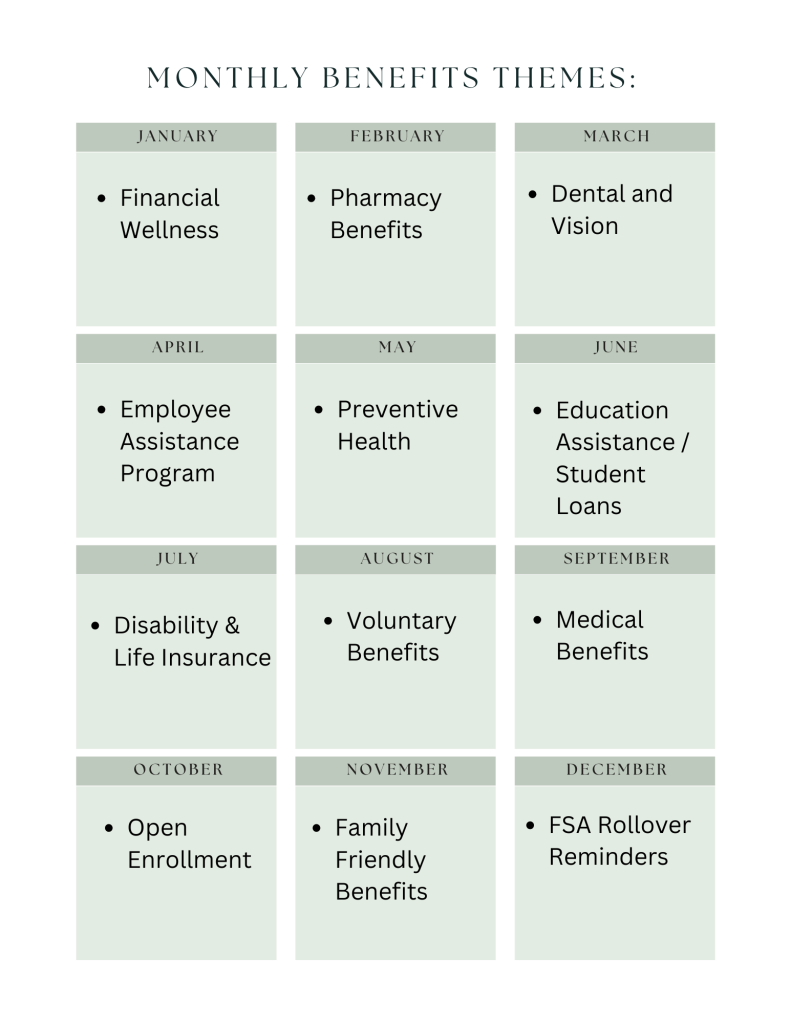

Think about what will be on the top of employee’s minds over the next several months and create a calendar that speaks to those needs. Here is an example of a quarterly calendar:

Q1: In the beginning of the new year, the mantra is “New Year, New You!” What benefits can help employees plan for their future throughout the year – and take the stress out of the decision-making process?

Q2: With the weather beginning to warm up and the beginning of spring, many employees start to be more active and spend more time outdoors. What benefits address overall health and well-being?

Q3: Summertime means vacations for many families. This is a good time to address a healthy work-life balance and to give reminders about time off and childcare benefits.

Q4: When the weather starts to turn cooler, Q4 is in full gear! And that means one thing: Open Enrollment Season. Do your employees have the information to help them pick the right plan for the upcoming year?

Here is an example of some themes to incorporate into a monthly calendar:

Benefits education is communicating information about available benefits in ways that employees can connect to and understand. Communicating benefits information year-round is important because employees’ lives – and their situations – are constantly changing. They get married, divorced, adopt a child or have medical challenges arise. They are thinking about their health and financial security and how to adapt to it. If employees are engaged with their benefits throughout the year, they are more likely to value and use their benefits and will be better informed about their decisions and/or changes they need to make during the next Open Enrollment period!

by admin | Mar 13, 2023 | Employee Benefits

Employee benefits and open enrollment may be something you only think about a few times a year, and for your employees, it might be even less often. However, with a thoughtful, year-round communications plan, your business can increase employee engagement and smart benefits utilization.

Employee benefits and open enrollment may be something you only think about a few times a year, and for your employees, it might be even less often. However, with a thoughtful, year-round communications plan, your business can increase employee engagement and smart benefits utilization.

Many employees don’t know what benefits are available or how to utilize them. And with many employees working remotely or on a hybrid schedule, communication is even harder. Only communicating with employees regarding their benefits package during open enrollment will most definitely result in them not taking full advantage of all it has to offer. So, what are some creative ways to engage employees with their employee benefits throughout the calendar year?

START WITH THE END IN MIND

As you begin crafting your engagement plan, think of the overall goal you want to accomplish. Perhaps you simply want your employees to be better educated on their plan offerings. Maybe you’d like to reduce the number of questions that employees ask during open enrollment meetings. Maybe you want your employees to utilize a certain plan benefit that has been historically underused resulting in higher costs to the employee or the company. Whatever the case, first set your goal for the communication plan.

CREATE A CALENDAR

Now that you have an end-goal in mind, start thinking of how frequently you want to communicate. Schedule your communication moments to post consistently. Maybe you start a “Benefits Minute” that hits the first Monday of the month. You could also start a “Benefits Blog” that posts every other Friday. Whatever the case, make the communication happen on a schedule so that employees know when to expect it and know what it’s called.

9 out of 10 employees will choose the same benefits year after year. Creating a consistent educational calendar gives people time to find out and digest changes. Be sure to send information and reminders to avoid unwelcome surprises.

KEEP IT SIMPLE

Get to the main point quickly. If your communications are long-winded, employees will likely tune out before they receive the pertinent information. Instead, follow this simple formula when crafting your communication:

- Pitch – “Here’s something you may not know about your benefits.”

- Why – “This is why it’s important/relevant to you.”

- Call to Action – “Here’s what you should do to learn more,

MIX UP YOUR COMMUNICATION STYLE

Communication isn’t one-size-fits-all. People learn in different ways—some may be visual learners while others may be oral learners. Make sure you mix up the way you communicate to cover both types. Also, change up the method of communication. Try emails, videos, printed flyers, and quick virtual presentations. The idea is to get your message out through every channel available to ensure you’re reaching the entirety of your audience.

Ultimately, a good benefits package attracts and retains talent and increases the productivity of people. Following through with strong employee benefit communication is equally as important as the implementation. By following through with consistent and relevant benefits education, you will see that your employees will reap the benefits of a healthy understanding of their benefit plan!

by admin | Jul 7, 2017 | Benefit Plan Tips, Tricks and Traps, Employee Benefits, Human Resources

Many employers have invested in benefits administration systems to streamline their processes and connectivity with payroll systems as well as external vendors. From an efficiency and reporting perspective, this works wonderfully. However, when it comes to leveraging that technology for open enrollment and benefits communication, there can be gaps that limit effectiveness.

Many employers have invested in benefits administration systems to streamline their processes and connectivity with payroll systems as well as external vendors. From an efficiency and reporting perspective, this works wonderfully. However, when it comes to leveraging that technology for open enrollment and benefits communication, there can be gaps that limit effectiveness.

Our recent survey found that while technology plays a big role (47 percent of surveyed employees used a platform to enroll in their benefits), only 15 percent used an online tool to learn about their options. The good news is that of those who sought information, 90 percent found that interactive digital experience to be helpful.

The question then is, how do we encourage employees to seek information about the benefits available to them?

In a previous blog post, we talked about the power of personalization. Employees want the ability to customize their benefits package to meet their needs. This can seem challenging if your enrollment experience is limited to a simple (or overly complex) menu of benefits, only accompanied by the ability to elect participate, or waive (some may include links to product information). From a data perspective, this can be a seamless HR experience—but is it a great experience for employees?

There are several ways to create a better employee experience and your UBA advisors and vendor partners can help.

When you are planning your next open enrollment, ask your benefits administration partner what, if any, benefits communication tools they may have. Some platforms have started to incorporate dynamic video and animated presentations that help personalize the enrollment experience. Highlight these tools to your employees as part of the pre-enrollment communication package.

Insurance providers and other vendors are also great resources. Insurers may have product calculators to help employees determine coverage amounts that make sense for them. They may also have videos as well as single sign-on links that provide employees additional information. The same types of tools may be available from other vendors, such as health savings account (HSA) administrators.

Consider one-to-one employee meetings with a benefits counselor. Eighty-six percent of surveyed employees said they want a clearer explanation of benefits choices, and 80 percent want one-on-one time. Remember, your employees learn differently, and many could benefit from having a personal conversation about their needs. In many cases, it is possible to work with a carrier, or vendor, that can actually conduct the meetings and enroll employees on the benefits administration platform. The one-on-one meetings help employees learn about options specific to their circumstances, and the on-site representative can help guide them on how to use the system. This can also be an opportunity to update employee information such as dependents, beneficiaries, and contact information.

Successfully blending personalized benefits communication strategies with benefits administration technology can help increase employee engagement and streamline your processes.

By Kevin D. Seeker

Originally Posted By www.ubabenefits.com

by admin | Mar 7, 2017 | Benefit Plan Tips, Tricks and Traps, Human Resources

Last fall I had the pleasure of hosting a UBA WisdomWorkplace webinar called “Success in Voluntary through Strategic Benefits Communication.” I discussed recent Sun Life survey data regarding employee engagement and understanding of the value of voluntary benefits.

Last fall I had the pleasure of hosting a UBA WisdomWorkplace webinar called “Success in Voluntary through Strategic Benefits Communication.” I discussed recent Sun Life survey data regarding employee engagement and understanding of the value of voluntary benefits.

In the world of voluntary insurance carriers, success in voluntary benefits can be measured in various ways. A key metric is employee participation. For carriers, this is important because the greater the employee participation in a voluntary product, the better the spread of risk, which leads to appropriate margins and sustainable pricing.

But in the world of HR, this has not been a key metric. While good participation can reflect employee acceptance (and low participation might raise the question about whether the product is worth the time it takes to administer payroll deductions and facilitate billing), employee engagement has become more important.

This concept of knowing what you’re participating in makes me think about a good friend of mine who, a few years ago, reached out to me in a panic. He works for a large corporation with employees spread across the country. His employer was dropping all medical plan PPO options for the coming year and switching to a high- and higher-deductible option. He was sent an e-mail that provided few details but explained the action was due to high health care costs. There was no indication that more information was forthcoming, and the communication as a whole was insufficient because he couldn’t find answers to the questions he needed, the most important being, “what does this mean to me and my family?” I explained recent trends and how a high-deductible health plan (HDHP) with a health savings account (HSA) could be advantageous to him, but as we all know, not everyone is knowledgeable about their benefits or has friends in the business to explain their options.

When employees aren’t engaged in good benefits decision making, they can misunderstand or underuse their plans. Our recent survey showed that while employees are becoming more aware of changes in their medical plans, 54 percent still don’t know their out-of-pocket maximum, and 33 percent don’t know their deductible.

Employees are, however, concerned about their financial risks, and most do not have emergency savings or a cash flow to handle unexpected medical expenses. Moreover, research from the Federal Reserve shows that some people actually choose to forgo needed medical care simply because they cannot afford it.1

While these data point out employee challenges, our research does provide some encouraging feedback that shows how we might be able to help employees become knowledgeable about their benefits choices.

For example, though employees understand the benefits gap, 62 percent of those surveyed say they need additional coverage. We also learned that 70 percent were not familiar with the term “voluntary benefits,” but once they understood what voluntary products are, 63 percent agreed that these benefits are helpful in filling the gaps in health care coverage, even if they have to pay for these benefits themselves.

The real kicker is that 87 percent say more customized benefits choices that fit their specific lifestyles would help them make the right health plan choices.

This is where strategic benefits communication can play a vital role. In addition to ensuring that employees really understand the value of all of their benefits, including true total compensation, a well-planned communication effort engages employees by empowering them with information so they are confident in their open enrollment decisions.

How will you know whether you have been a successful communicator? In subsequent posts, we will talk about gathering employee feedback.

Over the next few months, this blog series will examine the ways HR benefits professionals can achieve success—not just in offering voluntary products to employees, but more important, in their overall benefits communications.

By Kevin D. Seeker

Originally published by www.ubabenefits.com

For most organizations, employee benefits communication kicks into high gear during open enrollment season. During this time, there is a surge in emails, educational webinars, fliers throughout the office, and a barrage of forms demanding signatures.

For most organizations, employee benefits communication kicks into high gear during open enrollment season. During this time, there is a surge in emails, educational webinars, fliers throughout the office, and a barrage of forms demanding signatures.