by admin | Aug 15, 2017 | Compliance, Health & Wellness

Where to Start?

Where to Start?

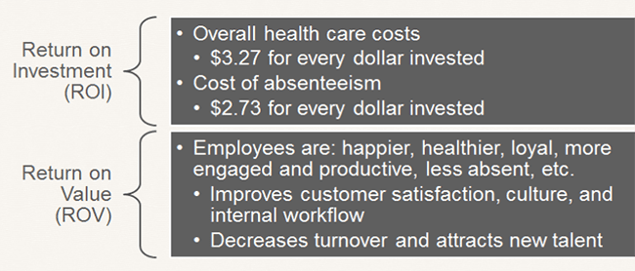

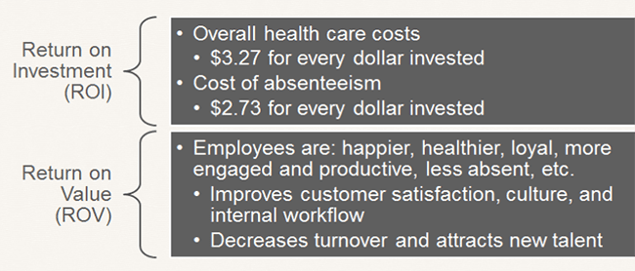

First, expand the usual scope of wellness activity to well-BEING. Include initiatives that support more than just physical fitness, such as career growth, social needs, financial health, and community involvement. By doing this you increase your chances of seeing a return on investment (ROI) and a return on value (ROV). Qualitative results of a successful program are just as valuable as seeing a financial impact of a healthier population.

Source: Katherine Baicker, David Cutler, and Zirui Song, “Workplace Wellness Programs Can Generate Savings,” Health Affairs, February 2010, 29(2): pp 304-311

To create a corporate culture of well-being and ensure the success of your program, there are a few important steps.

- Leadership Support: Programs with leadership support have the highest level of participation. Gain leadership support by having them participate in the programs, give recognition to involved employees, support employee communication, allow use of on-site space, approve of employees spending time on coordinating and facilitating initiatives, and define the budget. Even though you do not need a budget to be successful.

- Create a Committee or Designate a Champion: Do not take this on by yourself. Create a well-being committee, or identify a champion, to share the responsibility and necessary actions of coordinating a program.

- Strategic Plan: Create a three-year strategic plan with a mission statement, budget, realistic goals, and measurement tools. Creating a plan like this takes some work and coordination, but the benefits are significant. You can create a successful well-being program with little to no budget, but you need to know what your realistic goals are and have a plan to make them a reality.

- Tools and Resources: Gather and take advantage of available resources. Tools and resources from your broker and/or carrier can help make managing a program much easier. Additionally, an employee survey will help you focus your efforts and accommodate your employees’ immediate needs.

How to Remain Compliant?

As always, remaining compliant can be an unplanned burden on employers. Whether you have a wellness or well-being program, each has their own compliance considerations and requirements to be aware of. However, don’t let that stop your organization from taking action.

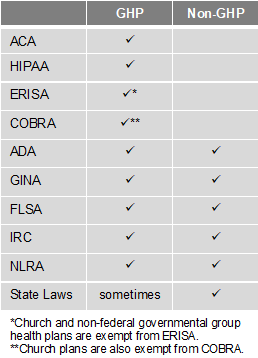

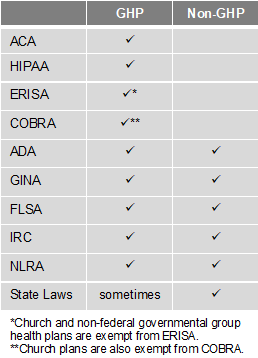

There are two types of programs – Group Health Plans (GHP) and Non-Group Health Plans (Non-GHP). The wellness regulations vary depending on the type of employer and whether the program is considered a GHP or Non-GHP.

Employers looking to avoid some of the compliance burden should design their well-being program to be a Non-GHP. Generally, a well-being program is Non-GHP if it is offered to all employees regardless of their enrollment in the employer’s health plan and does not provide or pay for “medical care.” For example, employees receive $100 for attending a class on nutrition. Here are some other tips to keep your well-being program Non-GHP:

- Financial: Do not pay for medical services (e.g., flu shots, biometric screenings, etc.) or provide medical care. Financial incentives or rewards must be taxed. Do not provide premium discounts or surcharges.

- Voluntary Participation: Include all employees, but do not mandate participation. Make activities easily accessible to those with disabilities or provide a reasonable alternative. Make the program participatory (i.e., educational, seminars, newsletters) rather than health-contingent (i.e., require participants to get BMI below 30 or keep cholesterol below 200). Do not penalize individuals for not participating.

- Health Information: Do not collect genetic data, including family medical history. Any medical records, or information obtained, must be kept confidential. Avoid Health Risk Assessments (i.e. health surveys) that provide advice and analysis with personalized coaching or ask questions about genetics/family medical history.

By Hope DeRocha

Originally Posted By www.ubabenefits.com

by admin | Jun 9, 2017 | HSA/HRA, IRS

IRS Releases 2018 Amounts for HSAs

The IRS released Revenue Procedure 2017-37 that sets the dollar limits for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018.

For calendar year 2018, the annual contribution limit for an individual with self-only coverage under an HDHP is $3,450, and the annual contribution limit for an individual with family coverage under an HDHP is $6,900. How much should an employer contribute to an HSA? Read our latest news release for information on modest contribution strategies that are still driving enrollment in HSA and HRA plans.

For calendar year 2018, a “high deductible health plan” is defined as a health plan with an annual deductible that is not less than $1,350 for self-only coverage or $2,700 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $6,650 for self-only coverage or $13,300 for family coverage.

Retroactive Medicare Coverage Effect on HSA Contributions

The Internal Revenue Service (IRS) recently released a letter regarding retroactive Medicare coverage and health savings account (HSA) contributions.

As background, Medicare Part A coverage begins the month an individual turns age 65, provided the individual files an application for Medicare Part A (or for Social Security or Railroad Retirement Board benefits) within six months of the month in which the individual turns age 65. If the individual files an application more than six months after turning age 65, Medicare Part A coverage will be retroactive for six months.

Individuals who delayed applying for Medicare and were later covered by Medicare retroactively to the month they turned 65 (or six months, if later) cannot make contributions to the HSA for the period of retroactive coverage. There are no exceptions to this rule.

However, if they contributed to an HSA during the months that were retroactively covered by Medicare and, as a result, had contributions in excess of the annual limitation, they may withdraw the excess contributions (and any net income attributable to the excess contribution) from the HSA.

They can make the withdrawal without penalty if they do so by the due date for the return (with extensions). Further, an individual generally may withdraw amounts from an HSA after reaching Medicare eligibility age without penalty. (However, the individual must include both types of withdrawals in income for federal tax purposes to the extent the amounts were previously excluded from taxable income.)

If an excess contribution is not withdrawn by the due date of the federal tax return for the taxable year, it is subject to an excise tax under the Internal Revenue Code. This tax is intended to recapture the benefits of any tax-free earning on the excess contribution.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

by admin | May 3, 2017 | ACA, Benefit Management

A Summary of Benefits and Coverage (SBC) is four page (double-sided) communication required by the federal government. It must contain specific information, in a specific order, and with a minimum size type, about a group health benefit’s coverage and limitations. If an employer providing an SBC is a covered entity under the Section 1557 of the Patient Protection and Affordable Care Act (ACA), additional requirements apply.

A Summary of Benefits and Coverage (SBC) is four page (double-sided) communication required by the federal government. It must contain specific information, in a specific order, and with a minimum size type, about a group health benefit’s coverage and limitations. If an employer providing an SBC is a covered entity under the Section 1557 of the Patient Protection and Affordable Care Act (ACA), additional requirements apply.

On April 6, 2016, the Centers for Medicare and Medicaid Services (CMS), the Department of Labor (DOL), and the Department of the Treasury issued the final 2017 summary of benefits and coverage (SBC) template, group and individual market SBC instructions, uniform glossary of coverage and medical terms, a coverage example calculator, and calculator instructions.

The SBC is to be used by all health plans, including individual, small group, and large group; insured and self-funded; grandfathered, transitional, and ACA compliant. The new SBC must be used for plan years with open enrollment periods beginning after April 1, 2017. It will not be used for marketplace plans for the 2017 coverage year.

For fully insured plans, the insurer is responsible for providing the SBC to the plan administrator (usually this is the employer). The plan administrator and the insurer are both responsible for providing the SBC to participants, although only one of them actually has to do this.

For self-funded plans, the plan administrator is responsible for providing the SBC to participants. Assistance may be available from the plan administrator’s TPA, advisor, etc., but the plan administrator is ultimately responsible. (The plan administrator is generally the employer, not the claims administrator.)

Changes

The template includes a new “important question” that asks “Are there services covered before you meet your deductible?” and requires family plans to disclose whether or not the plan has embedded deductibles or out-of-pocket limits. This is reported in the “Why This Matters” column in relation to the question “what is the overall deductible?” and plans must list “If you have other family members on the policy, they have to meet their own individual deductible until the overall family deductible has been met” or alternatively, “If you have other family members on the policy, the overall family deductible must be met before the plan begins to pay.”

Tiered networks must be disclosed and the question “Will you pay less if you use a network provider?” is now included. The SBC also includes language that warns participants that they could receive out-of-network providers while they are in an in-network facility. The SBC also indicates that a consumer could receive a “balance bill” from an out-of-network provider.

The “explanatory coverage page” was dropped from the template.

The coverage examples provided clarify the “having a baby” example and the “managing type 2 diabetes” example, in addition to providing a third example of “dealing with a simple fracture.” The coverage example must be calculated assuming that a participant does not earn wellness credits or participate in an employer’s wellness program. If the employer has a wellness program that could reduce the employee’s costs, the employer must include the following language: “These numbers assume the patient does not participate in the plan’s wellness program. If you participate in the plan’s wellness program, you may be able to reduce your costs. For more information about the wellness program, please contact: [insert].”

The column for “Limitations, Exceptions, & Other Important Information” must contain core limitations, which include:

- When a service category or a substantial portion of a service category is excluded from coverage (that is, the column should indicate “brand name drugs excluded” in health benefit plans that only cover generic drugs);

- When cost sharing for covered in-network services does not count toward the out-of-pocket limit;

- Limits on the number of visits or on specific dollar amounts payable under the health benefit plan; and

- When prior authorization is required for services.

The template and instructions indicate that qualified health plans (those certified and sold on the Marketplace) that cover excepted abortions (such as those in cases of rape or incest, or when a mother’s life is at stake) and plans that cover non-excepted abortion services must list “abortion” in the covered services box. Plans that exclude abortion must list it in the “excluded services” box, and plans that cover only excepted abortions must list in the “excluded services” box as “abortion (except in cases of rape, incest, or when the life of the mother is endangered).” Health plans that are not qualified health plans are not required to disclose abortion coverage, but they may do so if they wish.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

by admin | Apr 19, 2017 | Health & Wellness, Human Resources

I am proud to say that I have been involved in corporate wellness since the mid-1980s. Helping employees live healthier and happier lives, as well as supporting employers with best-in-class tools to improve their cultures, have been my passion and purpose. I have witnessed and worked on corporate wellness since the time when physical health was the most important aspect of workers’ health. I cannot say I have worked with wellness since its inception, though. Corporate wellness has been around longer than many people think. To predict the future of wellness, we must understand its past.

I am proud to say that I have been involved in corporate wellness since the mid-1980s. Helping employees live healthier and happier lives, as well as supporting employers with best-in-class tools to improve their cultures, have been my passion and purpose. I have witnessed and worked on corporate wellness since the time when physical health was the most important aspect of workers’ health. I cannot say I have worked with wellness since its inception, though. Corporate wellness has been around longer than many people think. To predict the future of wellness, we must understand its past.

Writings about the effects of work exposure on workers and how to improve workers’ health and well-being can be found as early as the 1700s1. Later, the industrial revolution brought many health issues to workers such as working 14 to 16 hours a day, low wages, and very poor working conditions2. The World Health Organization’s (WHO) definition of health in the 1940s as “a state of complete physical, mental, and social well-being and not merely the absence of disease or infirmity” opened our eyes to the concept of health and wellness as a more complex one3. In addition, the work of Halbert Dunn in 1959 helped the word “wellness” circulate more widely in the public health field, but it was the CBS 60 Minutes program with Dan Rather in 1979 titled, “Wellness, there’s a word you don’t hear every day,” that created curiosity about what corporate wellness was at that time – emphasis on physical health4. Corporate wellness has evolved since then and many studies have been published leading to a wealth of knowledge on best practices, return on investment (ROI), value of investment, risk reduction, health improvement, and more. The March 2017 edition of Health Affairs was dedicated exclusively on the relationship of work and health, and health and work highlighting important recent studies on wellness. Wellness has moved from physical health to thriving in other dimensions such as emotional, financial, spiritual, social, and intellectual health. In addition, many theories on behavior change and behavior economics have been adopted in wellness programs and its incentive designs. Wellness has changed from a “nice to have” to a “must have” benefit, but it must be done right and implemented consistently in order to provide positive results that align with your company’s goals.

I don’t have a crystal ball or special powers, but I believe the future of wellness lies in the following:

- Millennials in the workforce will demand more sophisticated technology.

- The traditional health risk assessment will be replaced by a more holistic kind – check out the True Vitality Test from The Blue Zones. (The UBA Health Plan Survey finds that although 72.5 percent of wellness programs include health risk assessments, their use has been declining, dropping 10.5 percent in three years.)

- Wellness will be part of all successful companies’ business objectives – the Chief Wellness & Well-being Officer’s ultimate goal will be to build a culture of health, self-responsibility, and emotional balance. Wellness will be an important piece of this. For great examples of companies ahead of our time, check out Dr. Ron Goetzel’s work at the Institute of Health and Productivity Studies at John Hopkins School of Public Health.

- Non-traditional workplace environments will replace the health-damaging sitting and sedentary work environment of today.

- Wellness will be more integrated with benefits in general, but more specifically with high-deductible health plans (HDHPs) as a way to help employees fund them.

- ROI will no longer be the focus, and instead it will be part of a long-term business strategy.

- Wellness will have a wider impact overall where employees will thrive in the workplace and bring their health improvement skills to their families and communities.

We now know how to deliver wellness that positively affects cultures and population health. We don’t need any additional studies. All we need are brave and open-minded companies to embark on the journey of optimal wellness and well-being. This journey is full of trials and errors, but also full of self-discovery and growth that can build very profitable companies filled with employees who truly engage at work and thrive every day. Who is with me in this journey?

By Valeria S. Tivnan, Originally Published By United Benefit Advisors

by admin | Mar 31, 2017 | Employee Benefits, Group Benefit Plans, Human Resources

The age-old adage, “you get what you pay for,” certainly holds true in the stop loss industry. I cannot stress enough how important it is to look at more than just the premium rates on a spreadsheet.

The age-old adage, “you get what you pay for,” certainly holds true in the stop loss industry. I cannot stress enough how important it is to look at more than just the premium rates on a spreadsheet.

To understand the importance, let’s use the auto insurance industry as a comparable example. If you were purchasing car insurance for yourself, would you always accept the lowest price without doing a coverage comparison? How would you know if that insurance company might jack up your rates on renewal, or once you have an accident, or possibly delay your claims and find every reason or loophole not to pay them?

Apply that same thinking to stop loss coverage with larger dollar amounts at risk. Not every stop loss policy is alike and not every carrier is going to provide you with the coverage you are seeking. As an employer, you want to make sure the employee benefit plan you sponsor for your employees will not result in any significant liabilities for your company. You want the peace of mind of knowing there won’t be any surprises along the way.

All stop loss carrier policies are different. Over my 20-plus years in the industry, I have seen some very unique language and provisions in stop loss policies that most people would not notice without looking at the fine print. You must be aware of these potential provisions that could cause significant gaps in coverage between your employee benefit plan and your stop loss policy.

How can you best protect your company? You can start by working with your broker or administrator to narrow down the list of stop loss providers to those that best meet your needs. Brokers and administrators are best suited to understand the complexities of stop loss insurance and provide you with the best possible information regarding policies and choices.

By keeping this, and the following items, in mind during your selection process, you should be able to find a carrier to serve your needs.

The most important advice I can provide is to look beyond just price and at the actual stop loss policy. The lowest price doesn’t always mean the best value. So make sure to:

- Read the stop loss policy before you purchase your coverage

- Ask for a sample policy

- Understand ALL the provisions of the policy itself

- Ask your broker or administrator to review the policy if you don’t understand all the provisions

Additionally, there are a few other things you will want to look for, or ask about, when selecting a stop loss carrier. In part two of this blog, which will be posted the first week of April, I will discuss some of the most frequent items I have seen that cause issues or gaps in coverage.

By Steven Goethel, Originally Published By United Benefit Advisors

Where to Start?

Where to Start?