by admin | Apr 16, 2024 | Health Insurance

Insurance Costs

Insurance Costs

Consumers typically pay the following types of costs when they have insurance.

- Premium: The premium is an amount of money a consumer pays for a health insurance plan. The consumer and/or their employer usually make this payment bi-weekly, monthly, quarterly, or yearly. The premium must be paid regardless of how many services, if any, the consumer uses.

- Cost Sharing: Cost sharing is the share of costs for covered services that consumers must pay out of pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn’t include premiums, balance billing amounts for out-of-network providers, or the cost of non-covered services. Cost sharing in Medicaid and Children’s Health Insurance Program also includes premiums.

- Deductible: The amount a consumer must pay for covered health care services received before their plan begins to pay. For example, if a consumer’s deductible is $1,000, their plan won’t pay anything until the consumer has paid $1,000 for covered health care services. A plan with an overall deductible may also have separate deductibles that apply to specific services or groups of services. For example, a plan may have separate in-network and out-of-network deductibles.

- Copayment: A fixed amount ($20, for example) that a consumer pays for a covered health care service after they’ve paid their deductible.

- Coinsurance: The percentage of the costs of a covered health care service that a consumer pays (for example, 15% of the cost of a prescription) after paying a deductible.

See Appendix A for examples of how cost sharing works.

Tips to Know:

- Sometimes consumers with most types of health insurance don’t have to pay any cost sharing for certain services. This is often true for preventive services like flu shots and some cancer screenings. The goal is to keep enrollees healthy and catch health problems early.

- Many health insurance plans have an out-of-pocket maximum. This is the most a consumer could pay during a coverage period (usually one year) for their share of the costs of covered services. After they meet this limit, the plan will usually pay 100% of the allowed amount. This limit never includes the premiums, balance-billed charges, or care that the consumer’s plan doesn’t cover. Some plans don’t count all of a consumer’s copayments, deductibles, coinsurance payments, out-of-network payments, or other expenses toward this limit.

- In the majority of situations, the most important document for tracking health insurance costs is usually called an Explanation of Benefits (EOB). The EOB is a summary of health care charges that a health plan may send after a consumer receives medical care. It is not a bill. It shows the consumer how much their provider is charging the health plan for the care they received, and the amount the plan will cover. If the plan does not cover the entire cost, the provider may send the consumer a separate bill, unless prohibited by law.

Appendix A

Examples of Health Insurance Cost Sharing

This appendix provides some examples of how health insurance cost sharing works for consumers. These examples show different outcomes depending on whether a consumer has met their deductible and whether their health insurance includes out-of-network coverage. This information is intended to illustrate some of the basic steps that are typically used to calculate cost sharing in the absence of consumer surprise billing protections (or when such protections don’t apply).

IN-NETWORK:

A consumer receives covered items or services from an in-network provider or facility.

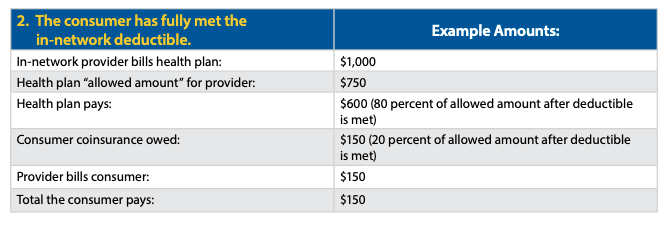

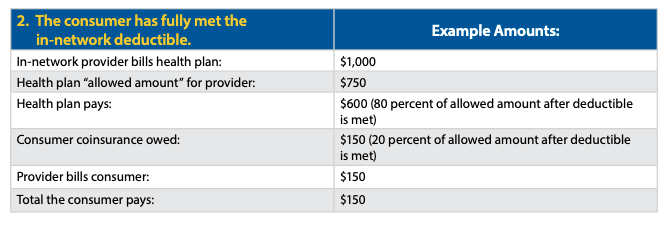

If the services are covered by the consumer’s health plan and furnished by an in-network provider or facility, the amount a consumer pays will vary based on whether the consumer has met their in-network deductible as well as the level of their coinsurance. Note the “allowed amount” is the maximum payment the plan will pay for a covered health care item or service and is generally the basis for cost-sharing calculations. In the next two examples, assume the consumer’s health plan specifies that coinsurance is 20 percent of the allowed amount after the consumer has met a $2,000 deductible for in-network coverage.

OUT-OF-NETWORK:

The consumer receives covered items or services from an out-of-network provider.

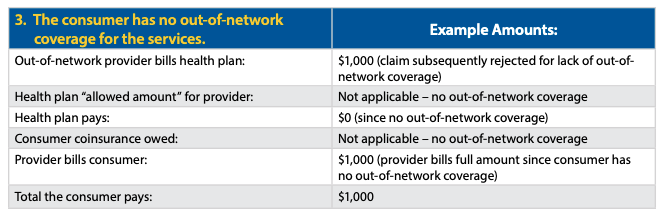

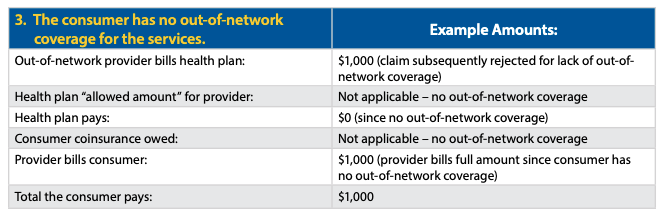

If the covered items or services are received out-of-network, a consumer’s billed amounts will vary based on whether the consumer’s health plan provides any out-of-network coverage and whether the consumer has met their out-of-network deductible.

In some circumstances, the No Surprises Act may limit what a consumer may be billed in each of the following examples. See the No Surprises Act: Overview of Key Consumer Protections.

In the next two examples, the plan covers out-of-network services with consumer coinsurance of 40 percent after the consumer has met a $4,000 deductible for out-of-network services. If the consumer has not paid anything toward the out-of-network deductible, the provider would bill the consumer for the full amount of the charges if the charges are less than $4,000 (example 4). If the consumer has already paid their full deductible, a provider might balance bill a consumer for the difference between what the provider receives from the health plan and the provider’s initial billed amount (example 5).

Originally posted on CMS.gov

by admin | Mar 26, 2024 | Health Insurance

Everyone needs health insurance but many people don’t fully understand it. One important concept to understand is your deductible. A deductible is the amount of money that must be paid for covered services before the health insurance company begins paying for expenses.

Everyone needs health insurance but many people don’t fully understand it. One important concept to understand is your deductible. A deductible is the amount of money that must be paid for covered services before the health insurance company begins paying for expenses.

For an individual plan, the deductible is straightforward. But family plans are a bit more complex.

Embedded vs. Non-Embedded Deductibles

Family health insurance plans can have one of two types of deductibles:

- Embedded Deductible (includes an individual and family deductible)

- Non-Embedded (Aggregate) Deductible (includes only a family deductible)

Understanding the specific type in your plan and how it operates can help you prepare for out-of-pocket healthcare costs.

Embedded Deductible: Each family member has an individual deductible in addition to the overall family deductible. Meaning if an individual in the family reaches his or her deductible before the family deductible is reached, his or her services will be paid by the insurance company. However, these will be paid solely for that family member. Once multiple family members’ medical expenses add up and surpass the family deductible, the insurer would begin to pay covered medical expenses for all members of the family. This applies even if a member did not meet their individual deductible.

Typically, embedded deductibles are exactly half of the entire family deductible. For example, the family could have a deductible of $10,000 and individual deductibles of $5,000 for every covered member of the family.

Embedded Deductible Example

Ashley and Robert have a family health plan that covers them and their two children. Each family member has a $4,000 individual deductible, and they have a $8,000 family deductible. Ashley meets her $4,000 deductible after giving birth to their son in March who was in the hospital for an extra week. Their daughter, Emma, has surgery in May and meets her $4,000 individual deductible in April, which means the family deductible of $8,000 has now been met. Later in the year, when Robert needs shoulder surgery, he only owes a co-payment because the family deductive was already met.

Non-Embedded Deductible: There is no individual deductible. So, the overall family deductible must be reached, either by an individual or by the family, for the insurance company to pay for services. The non-embedded deductible is most common in high insurance health plans.

Non-Embedded (Aggregate) Deductible Example

Marc and his family have a health plan with a non-embedded deductible. The family deductible is $10,000. Son Ben dislocated his shoulder and medical care cost $700. Daughter Victoria had acute appendicitis that required surgery costing $3,300. Marc had an accident while working on his farm which resulted in a hospital stay costing over $6,000. The combined out-of-pocket expenses from Marc, Ben, and Victoria’s medical treatments met the family deductible. Any further medical care for anyone in the family will be covered by the insurance company according to the plan benefits.

No matter what type of deductible your health plan uses, keep in mind that you must personally cover that amount before your insurance kicks in. When you understand how deductibles work and how it impacts your family’s household budget, you can make wise, informed choices to set aside funds for your family’s medical expenses.

by admin | Mar 12, 2024 | Health Insurance

Does a Health Plan Typically Pay for Services from Any Doctor?

Does a Health Plan Typically Pay for Services from Any Doctor?

Not always. Some types of plans encourage or require consumers to get care from a specific set of doctors, hospitals, pharmacies, and other medical service providers who have entered into contracts with the plan to provide items and services at a negotiated rate. The providers in this designated set or network of providers are called “in-network” providers.

- In-Network Provider: A provider who has a contract with a plan to provide health care items and services at a negotiated (or discounted) rate to consumers enrolled in the plan. Consumers will generally pay less if they see a provider in the network. These providers may also be called “preferred providers” or “participating providers.”

- Out-of-Network Provider: A provider who doesn’t have a contract with a plan to provide health care items and services. If a plan covers outof-network services, the consumer usually pays more to see an out-of-network provider than an in-network provider. If a plan does not cover out-of-network services, then the consumer may, in most non-emergency instances, be responsible for paying the full amount charged by the out-of-network provider. Out-of-network providers may also be called “non-preferred” or “non-participating” providers.

Some examples of plan types that use provider networks include the following:

- Health Maintenance Organization (HMO): A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won’t cover out-of-network care except in an emergency, or when a prior authorization to obtain care outside the network has been approved, or as otherwise required by law. An HMO may require a consumer to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness. An HMO may require enrollees to obtain a referral from a primary care doctor to access other specialists.

- Exclusive Provider Organization (EPO): A type of health plan where services are generally covered only if the consumer uses in-network doctors, specialists, or hospitals (except in an emergency). In general, EPOs do not require a referral from a primary care doctor to see other specialists, and in general there is very limited, if any, out-of-network coverage.

- Point of Service (POS): A type of plan where a consumer pays less if they use in-network doctors, hospitals, and other health care providers. POS plans may require consumers to get a referral from their primary care doctor in order to see a specialist.

- Preferred Provider Organization (PPO): A type of health plan where consumers pay less if they use in-network providers. They can use out-of-network doctors, hospitals, and providers without a referral for an additional cost.

Originally posted on CMS.gov

by admin | Feb 12, 2024 | Health Insurance

What is Health Insurance and Why is it Important?

What is Health Insurance and Why is it Important?

Health insurance is a legal entitlement to payment or reimbursement for your health care costs, generally under a contract with a health insurance company. Health insurance provides important financial protection in case you have an accident or sickness. For example, health insurance may help to pay for doctors’ services, medications, hospital care, and special equipment when someone is sick or injured, often in exchange for a monthly premium. It may help cover a stay at a rehabilitation hospital or even a portion of home health care. Heath insurance can also keep a consumer’s costs down when they are not sick. For example, it can help pay for routine check-ups. Most health insurance also covers many preventive services at no cost, such as immunizations and cancer screening and counseling.

What is a Health Insurance Plan (also called a health plan or policy)?

A health insurance plan includes a package of covered health care items and services and sets how much it will pay for those items and services. In other words, a health plan will describe the types of health care items and services it will cover (help pay for), how much it will pay for those items and services (or groups of items and services), and for how long. Plans are often designed to last for a year at a time (known as a “plan year” or “policy year”). A health plan may be a benefit that an employer, union, or other group sponsor provides to employees or members to pay for their health care services.

What are Some Types of Health Care Coverage?

Health care coverage is often grouped into two general categories: private and public. The majority of people in the U.S. have private insurance, which they receive through their employer (which may include nongovernment employers or government employers at the federal, state or local level), buy directly from an insurance company, or buy through a Health Insurance Marketplace®.1 Some people have public health care coverage through government programs such as Medicare, Medicaid, or the Veteran’s Health Administration. Health care coverage can also be categorized by the scope of benefits it offers or how long the coverage lasts. Health insurance often includes a wide range of covered services, including emergency and nonemergency services as well mental health benefits. Some people have very limited insurance plans, such as plans with benefits for only specific conditions or diseases (included in the list of “excepted benefits” under the Affordable Care Act, such as vision-only plans or cancer plans).

As noted above, many health plans offer coverage for a year. However, some plans offer coverage for less than 12 months, including plans created to fill gaps in coverage. These plans are called short-term limited duration plans, and they often offer fewer benefits as compared to other health plans and lack some of the consumer protections available under other forms of coverage.

Self-Insured Employer Plans vs. Fully-Insured Plans

For consumers who receive health insurance through their employer, there are typically two different funding structures employers use to provide coverage:

- Some employers offer health care coverage to their employees through a self-insured plan. This is a type of health plan that is usually offered by larger companies where the employer collects contributions from employees via payroll deductions and takes on the responsibility of paying all related medical claims. These employers can contract with a thirdparty administrator (in some cases, a health insurance company acting as an administrator) for services such as enrollment, claims processing, and managing provider networks. Alternatively, these employers can self-administer the services. Self-insured plans are regulated by the federal government and are generally not subject to state insurance laws.

- A fully-insured employer plan is a health plan purchased by an employer from an insurance company. The insurance company, instead of the employer, takes on the responsibility of paying employees’ and dependents’ medical claims in exchange for a premium from the employer.

Originally posted on CMS.gov

by admin | Dec 20, 2023 | Health Insurance

Protection from high medical costs

Protection from high medical costs

Health insurance provides important financial protection in case you have a serious accident or sickness. People without health coverage are exposed to these costs. This can sometimes lead people without coverage into deep debt or even into bankruptcy.

It’s easy to underestimate how much medical care can cost:

- Fixing a broken leg can cost up to $7,500

- The average cost of a 3-day hospital stay is around $30,000

- Comprehensive cancer care can cost hundreds of thousands of dollars

Having health coverage can help protect you from high, unexpected costs like these.

When you have coverage, your plan protects you from high medical expenses 2 ways:

- Reduced costs after you meet your deductible Once your spending for covered services reaches your plan’s deductible, the plan covers part of your medical expenses.

- Example: If your plan has a $1,000 deductible, you pay the first $1,000 in covered services. After that, your plan pays between 60% and 90% of your covered expenses, depending of what kind of plan you have. You pay between 10% and 40% of the costs as coinsurance or copayments.

- Out-of-pocket maximum This is the total amount you’ll have to pay no matter how much covered care you get in a plan year.

- Example: If your plan has a $3,000 out-of-pocket maximum, once you pay $3,000 in deductibles, coinsurance, and copayments the plan pays for any covered care for the rest of the year. This provides important peace of mind and protection from very high medical costs.

Pay less even before you meet your deductible

Even before you meet your deductible, you may save hundreds of dollars in medical costs.

How you save money before you meet your deductible

Insurance companies negotiate discounts with health care providers, and as a plan member you’ll pay that discounted rate. People without insurance pay, on average, twice as much for care. This means when you use a network provider you pay less for the same services than someone who doesn’t have coverage – even before you meet your deductible.

- Sometimes these savings are small. If you’re insured and use a network provider, you may pay $25 for a flu shot instead of the $40 someone without coverage pays.

- In other cases the savings can be big. If use a network provider, you may pay $85 for an office visit instead of the $150 someone without coverage pays. Savings can be even higher for more expensive services.

So even if you don’t reach your deductible during the year, you can save a lot of money on your covered medical services just by being enrolled in an insurance plan.

by admin | Nov 29, 2023 | Employee Benefits, Health Insurance

If you have a health plan through a job, you can use a Flexible Spending Account (FSA) to pay for health care costs, like deductibles, copayments, coinsurance, and some drugs. They can lower your taxes.

If you have a health plan through a job, you can use a Flexible Spending Account (FSA) to pay for health care costs, like deductibles, copayments, coinsurance, and some drugs. They can lower your taxes.

How Flexible Spending Accounts work

A Flexible Spending Account (FSA, also called a “flexible spending arrangement”) is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

You don’t pay taxes on this money. This means you’ll save an amount equal to the taxes you would have paid on the money you set aside.

Employers may make contributions to your FSA, but they aren’t required to.

With an FSA, you submit a claim to the FSA (through your employer) with proof of the medical expense and a statement that it hasn’t been covered by your plan. Then, you’ll get reimbursed for your costs. Ask your employer about how to use your specific FSA.

To learn more about FSAs:

Facts about Flexible Spending Accounts (FSA)

- They are limited to $3,050 per year per employer. If you’re married, your spouse can put up to $3,050 in an FSA with their employer too.

- You can use funds in your FSA to pay for certain medical and dental expenses for you, your spouse if you’re married, and your dependents.

- You can spend FSA funds to pay deductibles and copayments, but not for insurance premiums.

- You can spend FSA funds on prescription medications, as well as over-the-counter medicines with a doctor’s prescription. Reimbursements for insulin are allowed without a prescription.

- FSAs may also be used to cover costs of medical equipment like crutches, supplies like bandages, and diagnostic devices like blood sugar test kits.

- Get a list of generally permitted medical and dental expenses from the IRS.

- You can’t use a Flexible Spending Account with a Marketplace plan.

FSA limits, grace periods, and carry-overs

You generally must use the money in an FSA within the plan year. But your employer may offer one of 2 options:

- It can provide a “grace period” of up to 2 ½ extra months to use the money in your FSA.

- It can allow you to carry over up to $610 per year to use in the following year.

Your employer doesn’t have to offer these options. If it does, it can be either one of these options, but not both.

Plan ahead At the end of the year or grace period, you lose any money left over in your FSA. Don’t put more money in your FSA than you think you’ll spend within a year on things like copayments, coinsurance, drugs, and other allowed health care costs.

Originally posted on Healthcare.gov

Insurance Costs

Insurance Costs